Create Accounting Periods using a Calendar Year

A Calendar year is an accounting year where it starts on Jan. 1 and ends on Dec. 31.

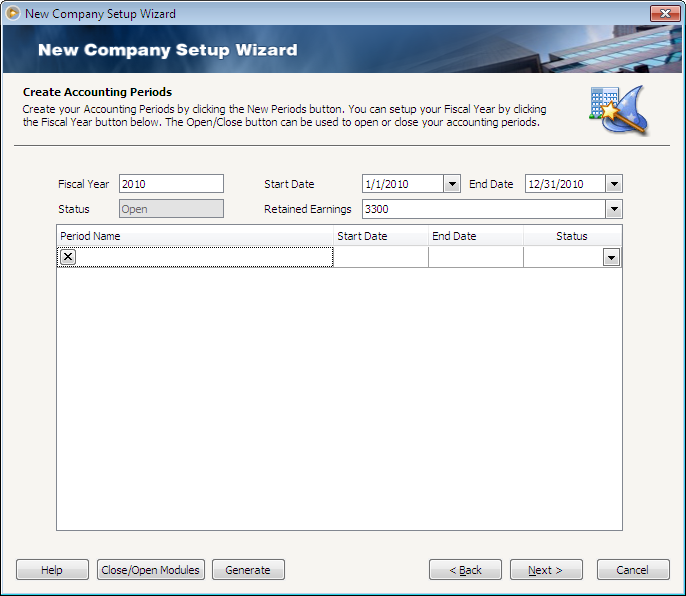

First, enter the Fiscal Year, the Start and End Dates and select the Retained Earnings account.

Then in the grid area, you can either enter the period names for the fiscal year along with the Start and End Dates or you can automatically generate periods by clicking the Generate button at the bottom of the form. When manually adding periods or automatically generating periods, by default, Status will show as Open.

The following steps will guide you on how to generate periods.

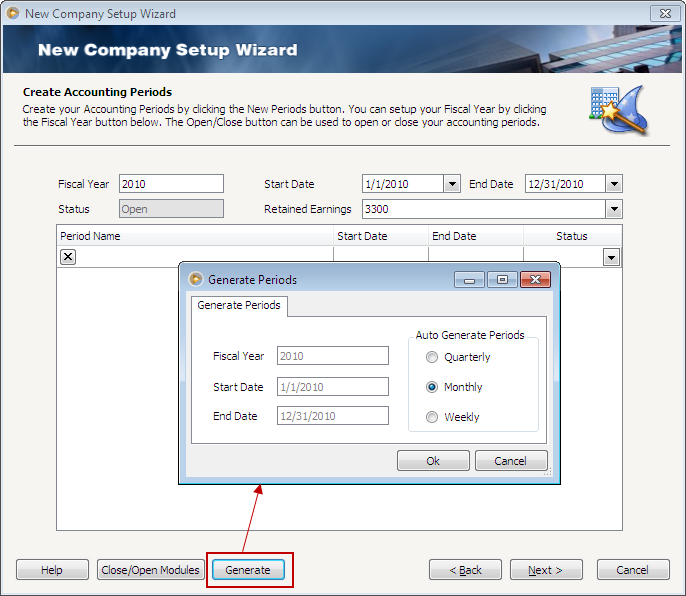

1. Click the Generate button to open the Generate Periods form. The Fiscal Year, Start Date and End Date read-only fields will show what had been setup in the Create Accounting Periods form. In the Auto Generate Periods, select periods to generate.

In this example, select Monthly to build 12 monthly periods and click OK.

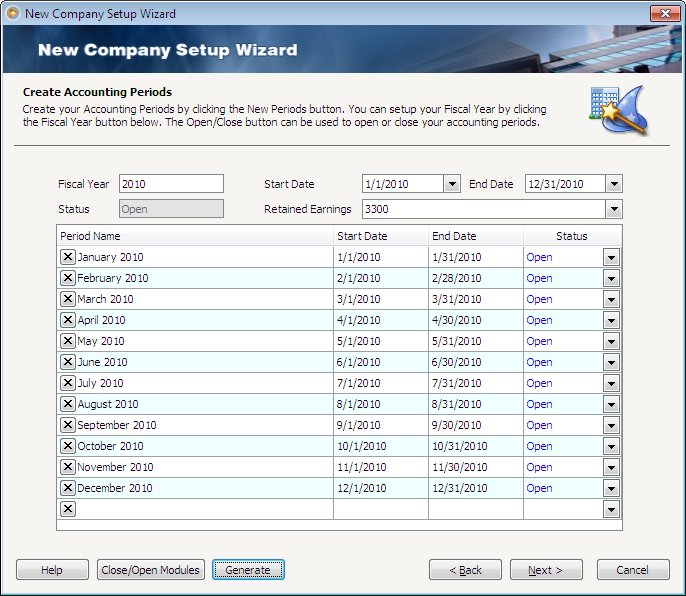

This is how your accounting periods will look like.

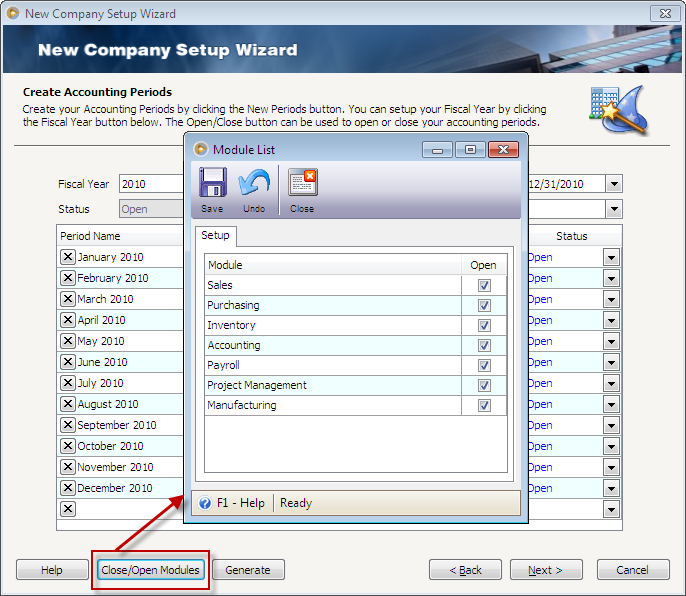

Click the Close/Open Modules button to open the Module List form where you can manage the posting of transactions per module. It is more like you are allowed to do everything on any modules except POSTING. This form lists all the modules that comprise VisionCore. You can use the Open checkbox to allow or not allow posting of transactions in a financial year for the particular module. When Open checkbox is unchecked, this will close the financial period for the selected module and will prevent particular transactions from being posted.

Aside from the actual calendar year (starts Jan 1 and ends Dec. 31 – the above illustration is an example of a calendar year) there is also the fiscal year. Fiscal year is an accounting year that ends on a date other than December 31. If your accounting year does not end in December 31, then see Create Accounting Periods using a Fiscal Year topic to show you how to configure your fiscal year periods.