Tokenization

The Tokenization feature (referred to as MToken) handles recurring credit card transactions faster and easier. This also follows the strict PCI Compliancy rules as per processing recurring credit card transactions. With this feature enabled, TranSentry sends and receives the transaction information and passes back only non-sensitive transaction data in the form of Token for all approved credit card transactions. This Token is used to replace sensitive card data like account number and expiry date. The token generated will also be stored and will be available every time you make credit card transactions, which prevents you from swiping or re-entering the credit card number once again.

Token Generation

A unique token is generated for each initial credit transaction request and for each subsequent use. If supporting tokenization for tip modification, adjustments, voids or recurring billing, it is important to note that a new token is always generated, replacing the original token. In the event of a decline/error response, no token is generated.

Token Frequency

Tokens may be stored for subsequent use or discarded if there is no business need. This is where Token Frequency will be used. Each token frequency option is described in detail below.

One Time

One Time token frequency is good for “general merchandise”-like business where customers would need to show or say their credit card number every time they do their purchase. This type of companies normally doesn’t need to know or track the credit card of their customers. The maximum life-span until a One Time token expires is approximately 6 months from the date the token record is generated.

Once credit card transaction is created using this type, token information will be saved for each transaction and will be used in the event of voiding credit card charges from a closed batch.

![]() Note that all Point of Sale transactions will be using One Time token frequency. There is a walk-in customer in Point of Sale that does not really need a recurring token.

Note that all Point of Sale transactions will be using One Time token frequency. There is a walk-in customer in Point of Sale that does not really need a recurring token.

Recurring

Recurring token frequency is good for companies who have memberships or with a good number of repeat sales for the same set of customers. The maximum life-span until a Recurring token expires is approximately 24 months from the date the token record is generated.

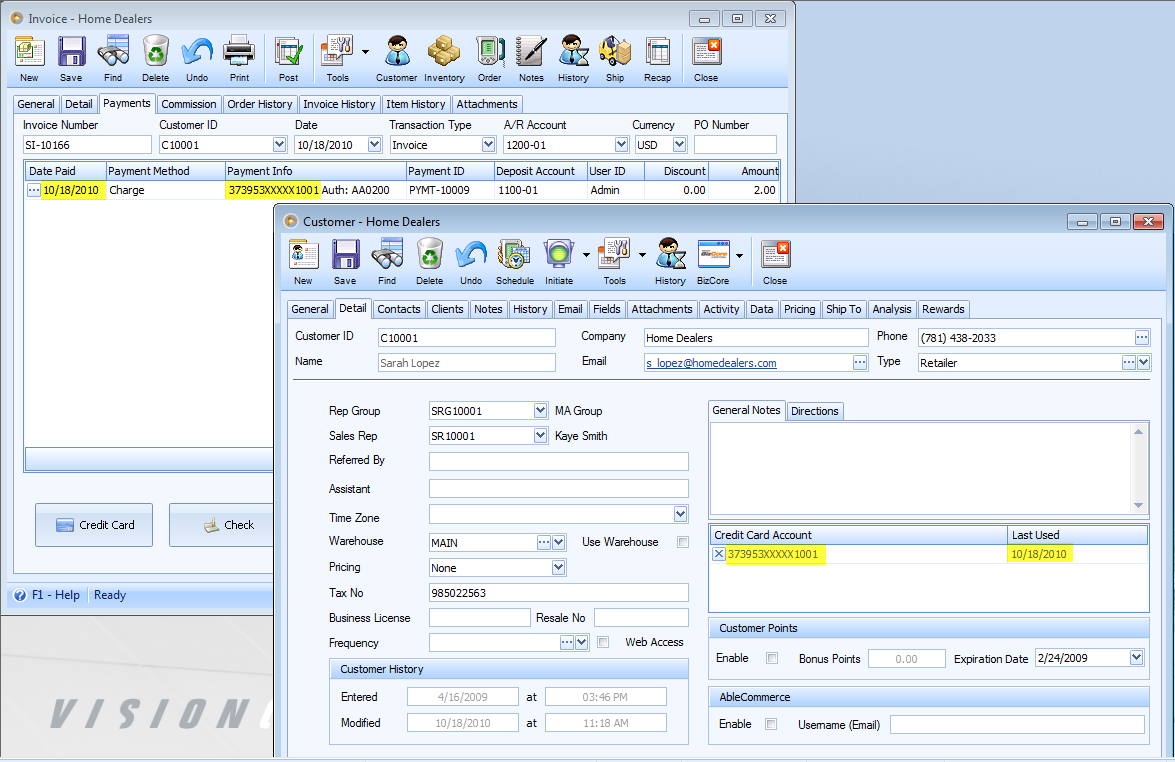

Like One Time, Recurring type also saves the token information for each transaction, however this will not only be used when voiding credit card charges from a closed batch but instead can be used to re-process the same credit card account or token each time they transact with the same customers without asking their credit card numbers again. That is why, Credit Card Accounts or tokens are listed in the Customer form > Detail tab > Credit Card Account.

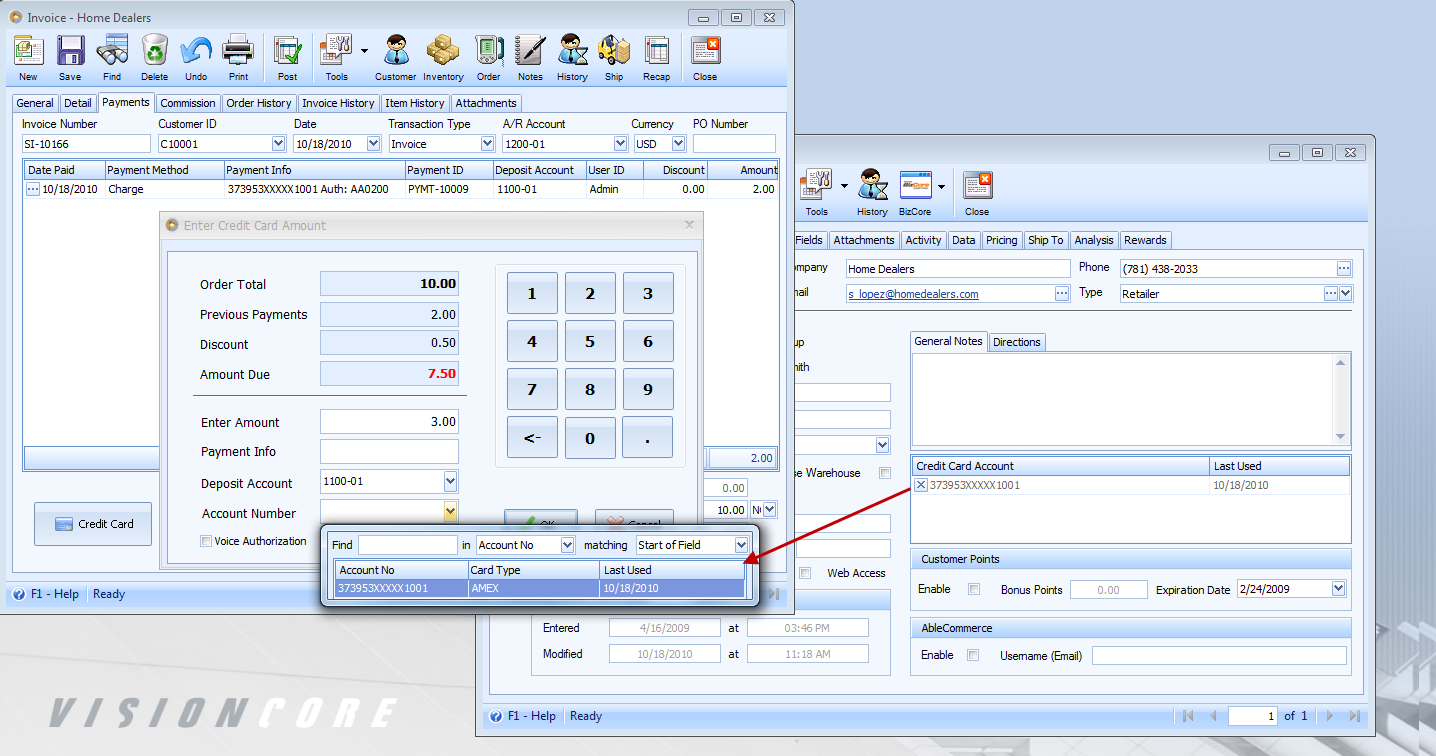

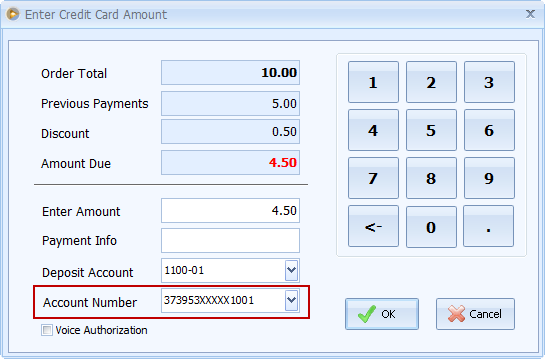

In the Enter Credit Card Amount form > Account Number combo box field, stored token along with the last 4 digits of their credit card, which can be reused to process a credit card will be displayed. Having this makes credit card processing faster since TranSentry form will not be anymore shown. Processing of the charge is made behind the scene using the Token ID, thus saving you some extra steps. Also, only tokens that belong to the customer will be available.

Example: On this screenshot, just select that same credit card account (or token) and click OK button and it will process the credit card transaction.

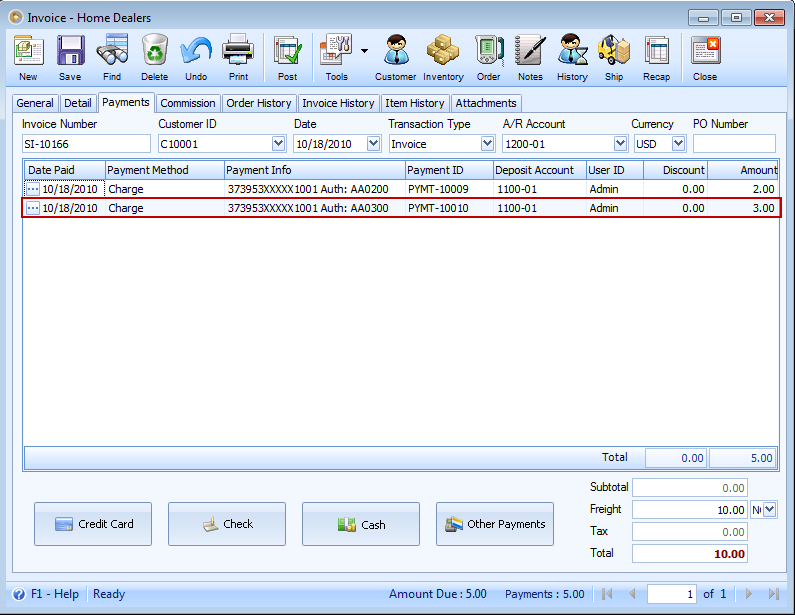

Here is the payment made from the above screenshot.

Another feature for Account Number field is it removes all the tokens or credit card accounts that have expired.

![]() Note that if your company will be processing credit card transactions using One Time and some using Recurring, it is recommended that you might as well use Recurring.

Note that if your company will be processing credit card transactions using One Time and some using Recurring, it is recommended that you might as well use Recurring.

For additional info about Credit Card Tokenization and some samples on how it works, see TranSentry and Credit Card Tokenization.